Several analysts and media outlets reported this week on the possible rise in gas prices later this year, perhaps as much as the record highs of 2022. Why are these predictions being made now and what are the underlying factors? At the same time, the story is broader than the price of gas alone. Security of supply, hydrocarbon dependency, and the climate impact of our energy supply also play a role. Below we set out three lessons for 2023 based on developments in the gas markets last year.

1. Don't count on the same windfalls as in 2022

The development of gas prices in 2022 was erratic: from record highs in the summer to a sharp decline towards the end of the year. Gas prices are currently still low, at pre-2022 levels (see below). Predicting this price is difficult. It is much easier to look back and point out the causes. The International Energy Agency (IEA) released two reports this week (see here and here) in which the institute reviews past events. Russian gas leaving the market creates scarcity, which in turn causes prices to rise. However, in the autumn, the dominoes all fell in exactly the same — favourable — direction to bring prices down.

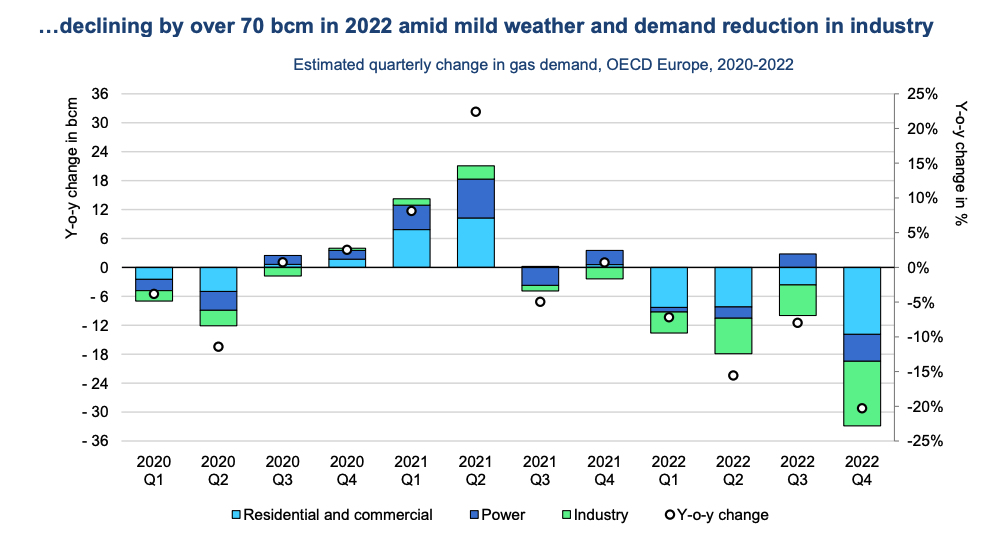

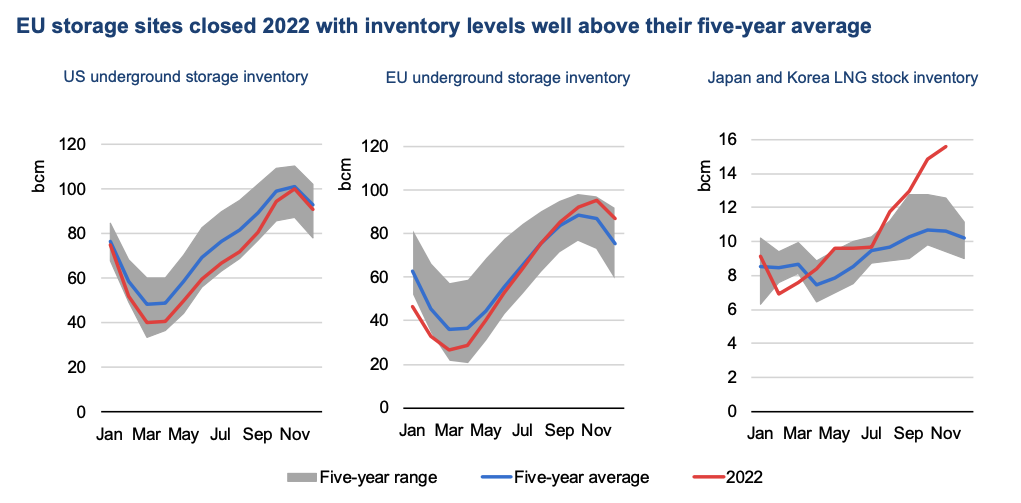

For example, European households and businesses managed to save much more energy than expected (see below). We also unexpectedly managed to fill our gas reserves faster and better than anticipated (see below). Furthermore, Europe's winter was much milder, requiring less gas than in other years. And because China was still largely in lockdown, energy demand there was relatively low, meaning that their supply could be diverted to European countries. Four factors that reduced demand and kept supply stable or helped lower prices. The chance that the dominoes will all fall favourably again is slim.

2. Choose for the longer term, not just the 'LNG quick fix'

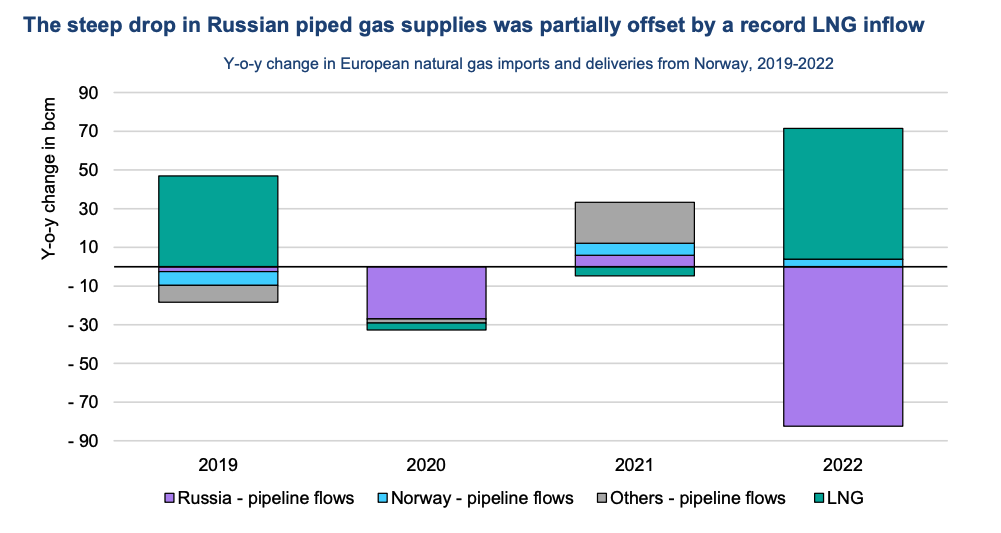

The same factors from 2022 will come into play in 2023. Energy conservation remains the best remedy, but the question is how much scope for savings remains. People have lowered their thermostats and industry has already picked the low-hanging fruit in terms of energy efficiency measures. The unpredictability of the weather needs no further explanation. For the other factors, LNG was often thought of as the "silver bullet". For example, gas from Russian pipelines (in its gaseous state) has been almost entirely replaced by LNG from the United States in particular (see below). While China is usually a major importer of LNG, demand there stalled due to disappointing economic growth.

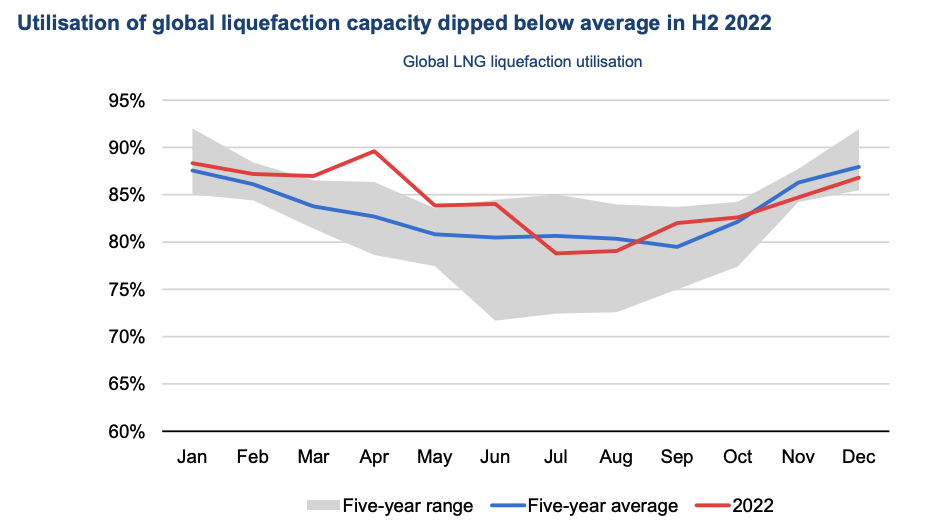

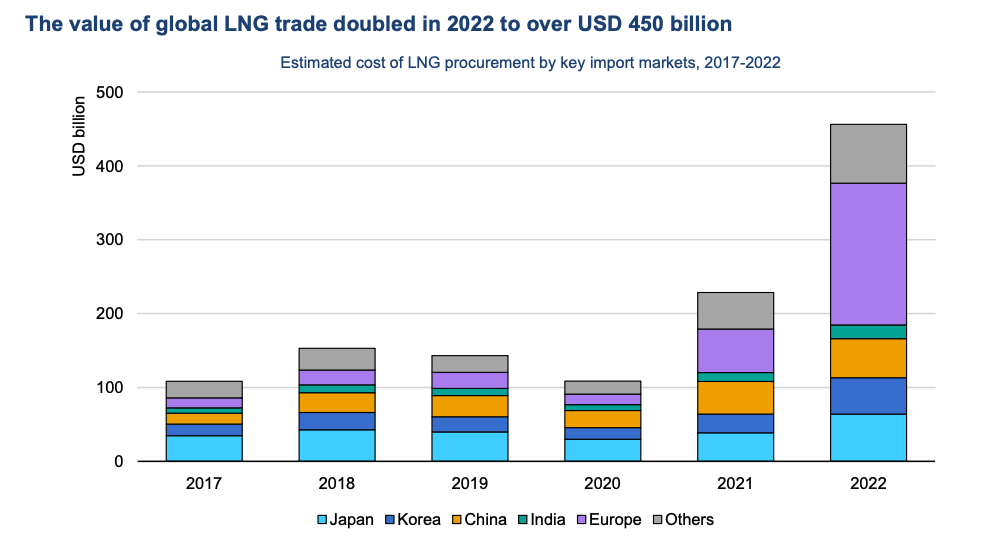

Unfortunately, LNG is not a tap that can be turned on and off, and the consequences of producing and transporting LNG are worse for the climate (more on that in Part 2). Production is already close to the maximum, and no new, large-scale production projects are due to come on stream soon because of long-term uncertainty. Last year clearly showed how this affects prices. The volume of LNG on the world market was no higher than usual, but sales revenues had doubled (see below).

Now that China has abandoned the zero-Covid policy and its economy is recovering, they are the defining factor in the LNG market. The new, joint European procurement policy strengthens our position, but that is no guarantee of a favourable price. In short, the many potential buyers for the limited LNG supply create uncertainty about gas availability, leading to price increases.

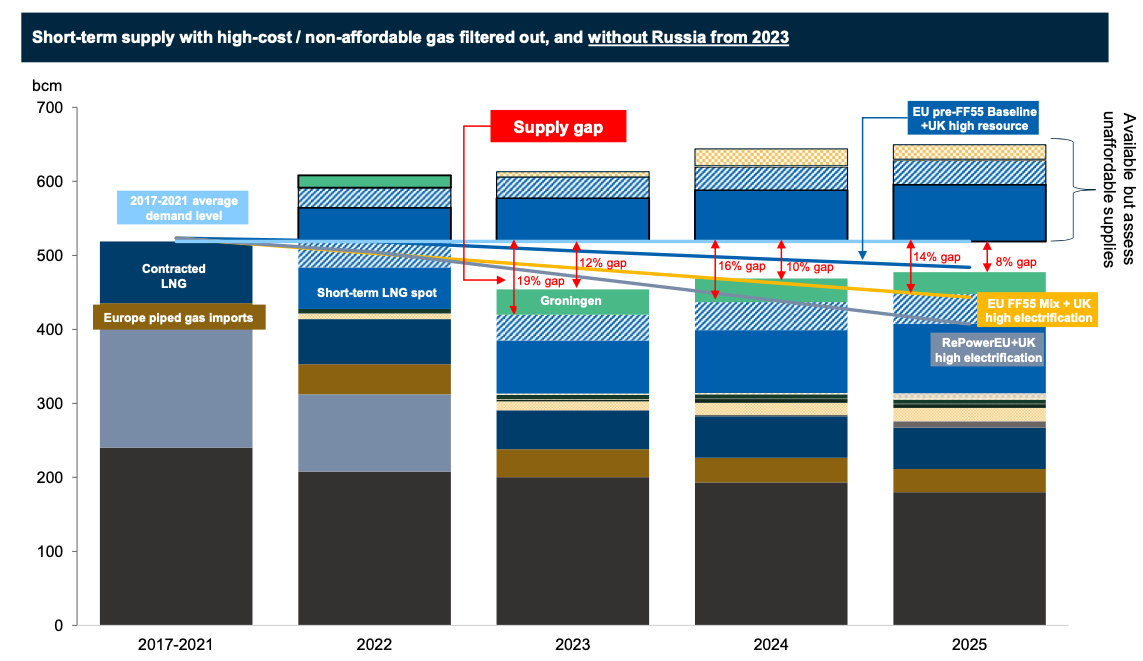

This means we might well see high gas prices, and perhaps even supply shortages, in the winter of 2023/24. The IEA is already seeing signs of this in the initial months of 2023, but the Rystad study from mid-2022 already anticipated that it would take until 2026 to fill the gap left by Russian gas (see below). Understandably, the government needs time to find alternatives to Russian gas, which comprised one-third of total imports before the war in Ukraine. Last year, considerable sums of money were allocated to quickly make up the shortfall with LNG imports, but this is not a viable policy for the longer term.

3. Reduce impact on the climate and poorer countries

For a rich country like the Netherlands, these prices are more or less affordable, but the gas market is global. Last year showed that poorer countries could not compete, resulting in "their" LNG ending up in Europe. This caused shortages (and power outages) in Pakistan, Bangladesh, Sri Lanka, Thailand, and India. Quite apart from being able to buy LNG, the key question is whether a country like the Netherlands should even want it.

Besides, LNG (from the United States or Qatar) is one of the most polluting forms of natural gas available. Recent research by TNO and CE Delft has shown that CO2 emissions from the production of LNG are up to six times higher than natural gas from the North Sea. And this does not even include the effects on the environment where shale gas is produced. Gas production in the North Sea may not be popular, but — looking at the bigger picture — it is still the less harmful option.

Conclusion

The gas market remains complex and difficult to predict. However, 2022 was a very unusual year that gave us valuable lessons we should not forget. Saving energy remains crucial, even though the perceived urgency may be lower now due to the price cap and lower gas prices. Furthermore, domestic gas production from the small fields and in the North Sea should not be further restricted but rather accelerated. Fortunately, that is also the objective of State Secretary Hans Vijlbrief's Acceleration Plan.

While it is understandable that decisions made in 2022 were dictated mainly by short-term needs, scarcity in the gas market will persist for years to come. This requires long-term solutions. For VVD MP Silvio Erkens, the government is not moving fast enough, which is why in February he announced a new bill to ensure the Netherlands is less energy-dependent, for example, by continuing to provide a stimulus for domestic production of North Sea gas. This will not only ensure that the Netherlands is less vulnerable, but is also better for the climate.

As contradictory as it may sound; gas production now offers the right route toward the 2050 climate goals. The lessons we learned in 2022 show us we need a clear long-term vision.